This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

China refines the vast majority of the world’s rare earth elements and produces nearly all of the highest-value magnets that turn electricity into motion—precisely the parts that make EVs roll, turbines spin, and drones lift. In April 2025, Beijing tightened export licensing on seven medium and heavy-rare-earth products. Traders and automakers warned that stockpiles would cover only three to six months if flows did not resume quickly. The immediate shock passed, but the structural lesson remained: the choke point is not just in the ground; it’s in the people, processes, and plants that transform ore into irreplaceable magnet performance. Japan looks vulnerable on geology yet surprisingly resilient on capability: it has diversified imports, funded recycling and substitution, built stockpiles, and is preparing ultra-deep trials to pull rare-earth-rich mud from its seabed. That program may or may not scale. But the deeper bet—often misdescribed as “synthesizing rare earths”—is really about synthesizing function through curriculum, labs, and industry-ready skills. Make the education system the supply chain hedge, and the monopoly’s grip loosens at the point of use, not just the mine.

From Elements to Functions: Reframing Resilience

Rare earths are elements; no one “synthesizes” neodymium or dysprosium in a lab at scale. What can be synthesized—deliberately designed—is the performance that policy cares about: torque in a motor, efficiency in a generator, precision in guidance systems. Japan’s portfolio response since the 2010 crisis has moved in four streams: reduce intensity (use less), substitute materials (use different), recycle (use again), and diversify sources (use elsewhere). The first three are effectively function synthesis—engineering pathways that deliver equivalent or “good-enough” magnet behavior without heavy reliance on China-controlled inputs and processes. They are also, crucially, talent-intensive. China still refines most rare earths and commands the magnet bottleneck; export controls on minerals and even on processing know-how tighten the vise. Yet Japan’s dependence on Chinese rare earth imports has fallen from roughly 90% after the 2010 shock to about 60% a decade later, due to stockpiles, overseas partnerships, and demand-side engineering. The reframing is simple: in a refining and magnet world that China dominates, competitive advantage hides in brains, not veins—in the education pipeline that turns abstract chemistry into resilient performance.

The Numbers Behind a Portfolio Hedge

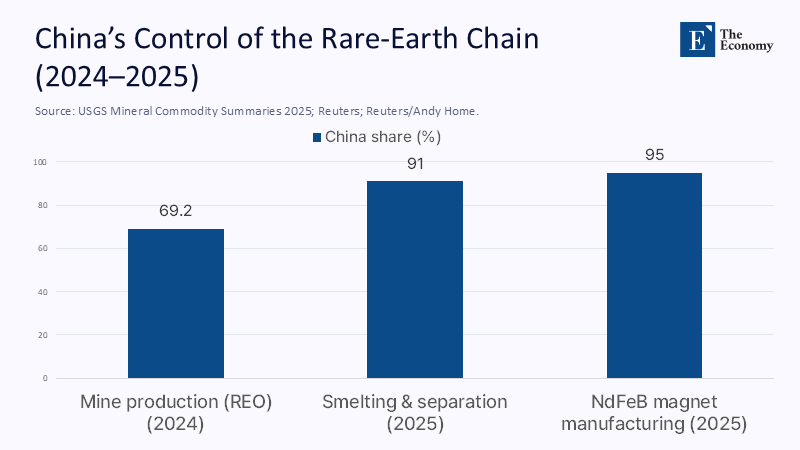

Start with concentration. China is the dominant refiner for 19 of 20 energy-transition minerals, averaging around 70% of refining across the basket; for rare earth permanent magnets, estimates cluster around 90% of global output. Heavy rare earth separation remains even more skewed—until very recently, China effectively processed nearly all heavy fractions like dysprosium and terbium. In April 2025, new licensing requirements covered seven medium and heavy elements as well as sure magnets, forcing a pause in shipments and testing every buyer’s “N-1” plan—the ability to keep operating if the most significant supplier is cut off. Meanwhile, USGS tallies still put China near 60–70% of mine output, with global production up but processing dominance intact. Against that, Japan has quietly layered partial hedges: strategic stockpiles managed through JOGMEC, equity ties into allied producers (notably Lynas), magnet-to-magnet recycling pilots, and design shifts such as Toyota’s neodymium-reduced, heavy-rare-earth-free magnet. Each is a marginal cut in exposure; together they change the slope of risk.

Figure 1: The choke point intensifies downstream: China’s share rises from mines to magnets, where performance—and policy leverage—are ultimately manufactured.

Figure 1: The choke point intensifies downstream: China’s share rises from mines to magnets, where performance—and policy leverage—are ultimately manufactured.

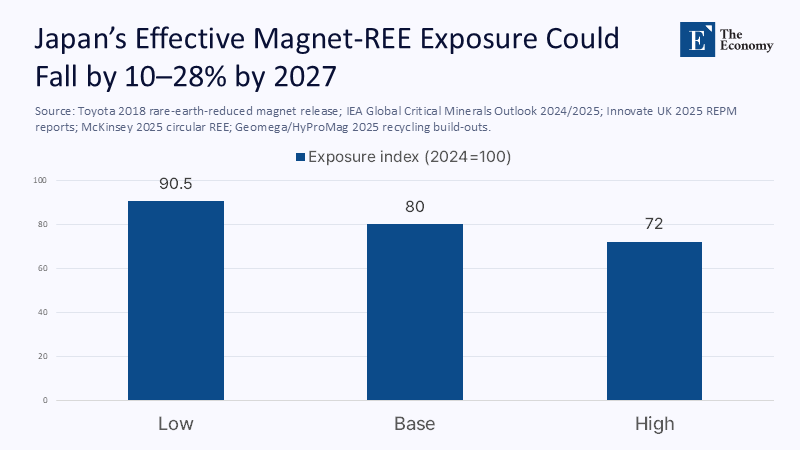

Method in the Estimates: What We Count—And What We Don’t

Because official figures on magnet inventories and firm-level contracting are opaque, we rely on transparent, conservative estimates. Take Japan’s “functional” exposure for EV drive motors. Suppose Japan-based automakers and suppliers require magnets equivalent to 40–60 kt REO annually within global supply chains, with a domestic share of that embedded in products made in or for Japan. If Toyota-style neodymium-reduction cuts REE intensity in drive motors by, say, 20–30% versus baseline NdFeB, and recycling can plausibly provide 5–10% of magnet feedstock by 2027 based on announced pilots and global experience curves, then a credible near-term reduction in effective dependence could be 10–20 percentage points without a single new domestic mine. That estimate triangulates from the IEA’s magnet-market dominance math, USGS production trends, Toyota’s published magnet chemistry, and reports on rising pilot-scale magnet recycling plants. It deliberately excludes speculative seabed volumes while including the option value of planned trials. Numbers alone won’t save a supply chain, but disciplined estimates help policymakers choose which levers education can pull fastest—training separation chemists and magnet process engineers beats waiting on geology.

Figure 2: Function-first hedging—Toyota-style reduced-Nd magnets plus early magnet-to-magnet recycling—can trim exposure materially even without new mines.

Figure 2: Function-first hedging—Toyota-style reduced-Nd magnets plus early magnet-to-magnet recycling—can trim exposure materially even without new mines.

Classrooms as Industrial Policy: What Educators Can Do Now

If performance substitution is the strategy, the classroom is the factory gate. Teachers can thread “critical-materials literacy” across physics, chemistry, and engineering: why NdFeB magnets dominate; how dysprosium improves coercivity at high temperatures; where ferrites and switched-reluctance motors win or fail. Universities can stand up “magnet-to-market” pilot lines that mirror the bottlenecks: solvent extraction and ion-exchange for separations; strip-casting, jet-milling, and sintering for magnet making; demagnetization and hydrometallurgical recovery for recycling. Each step is a lab, a lesson, a research project—and a talent pipeline. The demand signal is there: by 2033, the U.S. alone may need up to 3.8 million additional manufacturing workers, with advanced materials skills in short supply. Mining and metallurgical engineering programs already graduate far fewer students than the industry needs. Curricula should therefore prioritize separation science, process control, and environmental health, with embedded modules on compliance and lifecycle assessment to avoid the “dirty refinery” trap that underwrote China’s early cost advantage. The immediate goal is not a trophy new mine, but a generation that can design around constraints.

From Subsidy to Syllabus: What Administrators and Policymakers Must Align

Administrators can convert incentives into instruction. Tie research funding to hands-on training capacity: grants that pay for gloveboxes, inert-atmosphere mills, and pilot sintering furnaces should also fund course releases and technician lines. Align procurement with pedagogy by requiring recycled-content magnets in campus fleets and labs, forcing real sourcing exercises and data collection on quality and reliability. Policymakers should copy the clarity of the EU’s Critical Raw Materials Act—not its targets per se, but its measurable benchmarks—and apply them to human capital: X separation scientists per year, Y pilot-line technicians certified, Z joint appointments with industry. Bilateral initiatives (U.S.–Japan, EU–Japan) can fold curriculum standards and internships into mineral partnerships, so public money buys know-how, not just tons. When export controls slow flows, the “N-1” alternative should include an “E-1” requirement: education that sustains minimum viable production with less Chinese content. Use stockpiling to buy time, but spend that time on instruction that cuts intensity and diversifies capability, or the next licensing shock will look precisely like the last.

The Deep-Sea Bet—Promise, Peril, and a Research Agenda

Japan’s plan to test the extraction of rare-earth-rich mud at depths around 5,500 meters near Minamitorishima is audacious and scientifically valuable. It could surface heavy rare earths that magnets crave, and it would finally move “geology at home” from paper to pilot. But it is also environmentally and economically contested. Ultra-deep operations are expensive, technically brittle, and subject to public scrutiny; citizen trust will depend on transparent baseline data and independent monitoring. The proper education response is to teach across the boundaries: oceanography next to metallurgy; ecology next to economics. Run graduate studios that pair process design with environmental impact modeling; require students to publish monitoring plans before they propose extraction flowsheets.

Meanwhile, keep that option value grounded: the program’s near-term output is evidence and human capital, not commodity tonnage. If the trials demonstrate technical feasibility with acceptable impacts, the curriculum can scale to prepare the workforce; if not, the same students will be the ones who make recycling and substitution work. Either way, we win with people.

Anticipating the Critiques—and Rebutting Them with Facts

Critique one: “You can’t teach your way out of a monopoly.” True, education alone won’t replace ore, but policy is already shifting the risk frontier. In 2023–2025, Beijing restricted the export of processing technology and then layered licensing on selected elements and magnets. Those moves increased the value of substitution, recycling, and allied processing—precisely the domains where trained people, not raw deposits, decide outcomes. Critique two: “Substitutes don’t match performance.” In some niches, that’s right; in many others, incremental redesign closes the gap. Toyota’s neodymium-reduced, heavy-rare-earth-free magnets have been in the public domain since 2018 for high-temperature uses; ferrite-heavy and reluctance architectures continue to mature. Critique three: “Recycling volumes are trivial.” They are, for now, but the experience curve is real: published surveys count dozens of pilot and pre-commercial plants, and design-for-recycling standards can lift end-of-life collection yields. Critique four: “Japan still depends on China.” Also true—and so does everyone else. The point is the trajectory. Preparedness is measured by how fast you can lower the intensity and swap inputs when the following license takes effect.

Translating into Classroom Tactics and District Decisions

For K–12 systems, integrate case-based units that treat a motor not as a black box but as a bundle of material choices with geopolitical consequences. Make “design under constraint” a capstone: how do you hit performance targets with ferrites or with reduced neodymium? In technical colleges, build short, stackable credentials in solvent extraction, calcination and sintering control, and magnet demagnetization safety—skills that map directly to the processing and recycling bottlenecks. Universities require students in materials programs to pass modules on export controls, supply-chain due diligence, and lifecycle assessment, so graduating engineers can solve for performance and compliance at once. District leaders should partner with local industry to place equipment on campus and students on factory floors; ministries should subsidize those partnerships the way they subsidize exploratory drilling. And because deep-sea trials will remain controversial, embed community engagement and environmental monitoring as coursework. This is not “teaching about rare earths” as a curiosity; it is training operators and designers for the machines that will keep a country’s energy and mobility plans moving when the shipping queue stalls.

Syllabus for Strategic Autonomy

Return to the choke point. China’s market power does not end at the mine; it radiates from the processing plants and magnet factories staffed by trained experts and guarded by export controls and licensing. The fastest, most realistic hedge for other countries is to synthesize the function those magnets deliver—through reduced intensity, substitution, recycling, and more innovative design—and that work is unavoidably educational. Japan’s experience shows what that portfolio can do: dependence cut, stockpiles in place, alliances activated, design pathways already in products, and even a bold scientific probe into a domestic geological option. None of them claims victory. All of it buys time. Use that time to teach. Build pilot lines beside classrooms, put process engineers in front of students, and measure success not only in tons or tariffs but in the number of people who can wring performance from fewer constrained elements. If the next licensing shock arrives in months, the way to keep factories humming will be less about finding a new mine and more about graduating a new cohort. That is a race that schools can win—and must.

The original article was authored by Moon Hwan Lee and Kaori Kawaguchi. The English version, titled "Japan rolls the dice but China holds the cards in rare earth strategy," was published by East Asia Forum.

References

ACS Chemical & Engineering News. (2025, April 22). Will China’s rare-earth export rules spur production elsewhere?

CSIS. (2025, April 14). The consequences of China’s new rare earths export restrictions.

Deloitte & The Manufacturing Institute. (2024, April 2). Manufacturers support growth with active workforce strategies: Digital skills report.

East Asia Forum. (2025, August 2). Japan rolls the dice but China holds the cards in rare earth strategy.

European Commission. (2024). Critical Raw Materials Act—key targets and benchmarks.

Financial Times. (2025, June). China’s rare earths controls prompt fears of auto shortages and shutdowns.

IEA. (2024, May 17). Global Critical Minerals Outlook 2024.

IEA. (2025, May 21). Diversification is the cornerstone of energy security—critical minerals are moving in the opposite direction.

IEA. (2025). Global Critical Minerals Outlook 2025 (Executive summary).

Innovate UK. (2025, July). Innovation landscape report: Rare earth permanent magnet manufacturing.

JOGMEC. (n.d.). Stockpiling: Metals.

Reuters. (2023, December 21). China bans export of rare earth processing technologies.

Reuters. (2025, April 24). China is restricting mineral exports—how does its export control system work?

Reuters/Nikkei/Phys.org. (2025, July 3). Japan plans ‘world first’ deep-sea mineral extraction; test mining targeted for early 2026 near Minamitorishima.

Toyota Motor Corporation. (2018, February 20). Toyota develops new magnet aiming to reduce use of critical rare earth elements.

USGS. (2025). Mineral Commodity Summaries: Rare Earths.

World Economic Forum. (2023, October 13). How Japan solved its rare earth minerals dependency issue.

WSJ. (2025, July). China strong-armed Japan over rare earths. It’s a lesson for the U.S.